By Simba Mswaka

CHINA is the 2nd largest economy in the world and it has achieved unprecedented economic growth over the last thirty years. China has become an example to the rest of the world on how to uplift people from poverty and create a large working class population. The importance of China in global business cannot be understated and ignoring them would not be ideal for any nation.

Zimbabwe is a former British colony that shared a close bond with its colonial master but the relationship was eroded after the land reform program of 2000. This breakdown forced Zimbabwe to seek funding elsewhere and the country embarked on a look East Policy towards China and other Asian countries. Zimbabwe’s economic collapse and the hyper-inflationary situation in 2008 forced the country to come up with a new method to trade in goods and services and the country introduced a multi-currency trading environment because the global currencies would maintain value much better than the Zimbabwe dollar ever did.

The introduction of these currencies helped place the Zimbabwean economy on the correct trajectory going forward for the next few years and it was a welcome relief for the country, the citizens, trade was enabled and the economy began to pick up. The underlining problem was that Zimbabwe did not have its own currency and therefore it relied on exports, investment and purchase of the cash in order for citizens to have cash to trade with. Cash is in high demand in Zimbabwe and it is the preferred form of trade in the country. This placed significant pressure on the foreign currency reserves of the country and eventually in 2016 a crisis began to loom. Foreign currency began to dry up and it became difficult for Zimbabweans to transact. The Zimbabwean Reserve Bank (RBZ) introduced the Bond Note in order to facilitate trade and ease the demand for foreign currency. This worked initially but it was destined to fail because it became harder to replenish the foreign currency needed for trade.

The Zimbabwean crisis forced more people into using digital methods to transact such as POS machines and mobile money payment services. The country was not adequately geared for this but it became a situation of business unusual because of the cash shortages.

Zimbabwe has a healthy mobile penetration of 100.5% and therefore it was fairly easy for citizens to sign-up to mobile money services as opposed to opening bank accounts.

The government needs to find an alternative to the use of cash and I believe the answer lies in partnering and learning from China.

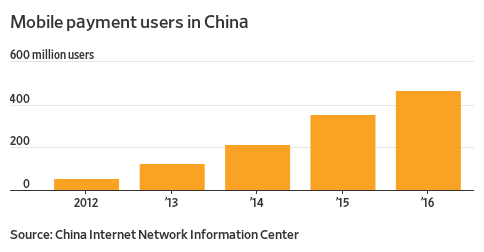

China is a country that has embraced mobile payments over the years and the Chinese make ample use of WeChat and Alipay to pay for goods and services. Even the smallest payments are made with the use of these applications. Cash is on the verge of extinction in China and in a country like Zimbabwe that does not have a currency and is finding it difficult to maintain cash reserves, they can use this as an opportunity to embrace change. Zimbabwe’s options are limited and the country needs to make a change in order to promote economic activity and general trade.

Zimbabwe should engage China in coming up with a strategy that makes cash less desirable in major cities and then this must be rolled out into rural areas and smaller towns. This reduced demand for cash will ensure that cash is only used when citizens travel outside of the country and for emergencies.

Strategic Plan

For Zimbabwe to become a fully cashless society there need to be a large investment into technology and high-speed internet by the government. These investments are intended to create an enabling environment whereby transactions are processed seamlessly and with no hiccups. If transactions are not fool-proof then the fall back will be cash and then the idea will lose momentum. The Chinese government has invested heavily in technology and it continues to upgrade its internet capabilities to increased levels so that the mobile payments system is always working. The Chinese government is on a drive to make China an economy driven by innovation and the digital economy is a key component of this.

This comes with large investments and research into new technologies that will make a cashless society even more of a reality in China.

In China there is large scale use of QR codes which are used for mobile payments. QR codes are a much more powerful tool that allows people like a small baozi vendor to operate with very low overhead costs. In the context of a developing country this is a very viable solution that enables the demand for cash to reduce.

The key facilitating tool in this process is the high number of smartphones that Chinese citizens own. This is made possible because smartphones are more affordable in China and poverty has been greatly reduced and there are local manufacturers such as Xiaomi and Huawei that create great products. The cost of transacting digitally is much lower than using cash and there is no safety issue around digital.

In Zimbabwe mobile payments are currently being used by large retailers and other services but they are not yet commonplace and people still have an affinity for cash. Public transport operators and informal traders demand cash for their services and this maintains the high prevailing demand for cash.

The Zimbabwean government needs to reduce the cost of transacting with mobile payments and then they should go on a drive to invest into infrastructure to create the necessary platform for mobile payments. The next step is a mass installation of QR codes and mobile payment touch points on all public transport vehicles so that commuters do not require cash to move from point A to point B.

The government cannot do this alone and in order to prosper they will create a Joint Venture with a reputable Chinese technology company. The ideal candidate being Huawei because of the size and scope of products that they offer.

The benefit of partnering with Huawei is that they have the skills, expertise and technology to make the goal of a cashless Zimbabwe a reality. Huawei has run big projects around the world and Zimbabwe is a fairly small country, therefore they will be able to implement the project in a short space of time given their experience. The urgency of the situation requires them to be able to implement timeously.

Huawei can build base stations across the country and target areas that have been previously neglected, such as the rural areas and Zimbabwe’s countryside. The majority of the rural population are farmers and they do not all have access to Wifi, high speed internet or mobile services. This increases their need to carry cash and by building networks in these regions, they will be able to have access to information and can now conduct their business without needing to go to the city. A farmer no longer requires cash on a daily basis to transact, but can now use their phone for such services. Countries which open up to foreign private participation in domestic investment opportunities benefit from technology transfer, synergies in the global supply chain, and resources development.

Huawei could also build a factory within the country where they can manufacture smart-phones to sell to Zimbabwean consumers. This will reduce the costs of the devices and allow more people to start making mobile payments a key part of their daily lives. The government should create a Special Economic Zone for this factory and give special concessions such as tax breaks to Huawei and other breaks for the number of jobs that they create. This will make investing into Zimbabwe a more lucrative exercise for Huawei.

The old adage of cash is king no longer reigns supreme in 2021 and going forward this scenario is set to change even further because of the speed that technology is advancing globally. The need for a cashless Zimbabwe has been precipitated on the country due to necessity and they should not miss out on the opportunity to digitise the country and move into the future. The downstream opportunities are immense and the country can provide a pilot project for Huawei to create cashless societies in other African countries that may suffer similar problems. The country has experienced hyper-inflation, lack of physical cash and a myriad of problems that have plunged the economy into a freefall and the next few years require a massive investment into the future to ensure that the country is able to trade in a sustainable fashion.