Complied by

- Magadze Kudakwashe

- Majome Tadiwanashe

- Mukara Ruramai

- Mdlongwa Elijah

- Shamhuyarira Ropafadzo

- Kamunda Angela

- Mlilo Rachel

- Hlupo Gary

- Chiketa Donald

- Makombe Alexander

Investment Summary

Founded in 2003 Dawn properties operates as a property holding company, a property consultancy that is engages in owning investment properties and offers valuation, management and consultancy services.

INVESTMENT SUMMARY

We issue a buy recommendation on Dawn Properties Limited with a target price of USc 68, presenting 6819% upside potential on the closing price of USc 1.00 on May 23th. Our valuation is based on a 75%/25% blend of a Discounted Free Cash Flow to Equity model and a PEG multiple analysis. Our recommendation is founded on the following key pillars: (1) structural growth drivers in Dawn’s underlying markets, (2) strong competitive position, and (3) solid financial position.

- Dawn benefits from expanding demand for real estate services. Dawn will continue to enjoy higher growth than expected, driven by its underlying markets’ growing dependence on the services. Growth dimensions are: (a) end-market growth due to new technological (e.g. IoT) and geographical markets, (b) rising complexity and consolidation of markets, (c) increasing market size as new customers move towards stable .

Business Description

Dawn properties limited has been in existence for more than 30 years offering real estate services to government owned parastals, institutions, financial service sector sand private sectors . It was incorporated on the 9th of September 2003 also; it was incorporated as a variable rate loan stock company by converting its ordinary shares into linked units. The core business of the company is that of an investment property holding company and through its wholly owned subsidiaries owns properties in the tourism sector.

Dawn properties operates as a property holding company, a property consultancy that is engages in owning investment properties and offers valuation, management and consultancy services and is listed on the Zimbabwe stock of exchange. The company earns rental incomes from the hotel and tourism properties that it owns and property management and consultancy fees from services provided by its subsidiary, Dawn Property Consultancy

The company’s sections comprises of an investment property section and a property service section. The company’s investment property section is based on investing in investment properties in the form of around eight hotel properties and tracks of land .The company’s property service section is involved in the real estate consultancy, building ,plant and machinery valuations ,and property management and agency .

Its mission is to create a sustainable value for its stakeholders. This is to be achieved by:

- Investing in high yielding properties;

- Optimizing net rentals by drafting appropriate lease agreements and closely managing costs;

- Ensuring that properties are properly maintained; and

- Ensuring that adequate attention is given to risk management.

Dawn Properties intends to invest in a balanced portfolio in order to minimize risk associated with any one asset class and to increase the liquidity of the portfolio and the core value of the business is to be a successful investment property holding and property development group. The core values of the business are as follows:

- Employment equity– We are committed to ensuring that employees are offered equal opportunities and appropriate participation.

Business Description and Cooperate Governance

- Integrity – We conduct our business in an honest, fair and transparent manner.

- Passion – We believe in our products and this drives all our innovations.

- Quality – We are committed to the highest standards of delivery.

- Teamwork – We believe in creating a happy work environment premised on teamwork.

- Environmental issues – We are committed to safeguarding the environment for this and future generations. The assessment of environmental issues is therefore critical for all projects we are involved in. We are committed to complying with environmental, health and safety standards.

Cooperate Governance

Dawn Properties Ltd accepts and complies with the principles of the Code of Corporate Practices as enunciated in the Zimbabwe Corporate Governance Code. The directors are fully aware and cognisant of the importance of executing their duties in keeping with the principles of transparency, integrity, fairness and accountability and in accordance with accepted corporate practices in order to enhance the interests of its shareholders, employees and other stakeholders. This includes timely and meaningful reporting to all its stakeholders.

Board of Directors

The board of directors comprises of six non-executive directors and two executive directors. The non-executive directors bring to the board a wide range of skills and experience that enables them to contribute independent views and to exercise objective judgement in matters requiring the director’s decision. It is important for a company to show the public and its internal staff the profiles of its directors as it boosts confidence and shows that they are being led by renowned people.

Cooperate Governance

Board of Directors Profiles

DIRECTORS QUALIFICATIONS AND EXPERIENCE

Board of Directors Profiles

DIRECTORS QUALIFICATIONS AND EXPERIENCE

Phibion Pasipanodya CEO of Baker Tilly Chartered Accountants

Chairman Holder of Bachelor of Accounting Science Degree and an

App: 10June2010 Honours Degree from UNISA.

28 Years’ experience in the accounting field, 24years in public

Accounting and auditing.

Murisi Mukonoweshuro Qualified Accountant and a member of the Institute of Chartered

Non-executive director Accountants of Zimbabwe

App: 1 Jan 2013 Served at Deloitte and Touché Zimbabwe, Old Mutual Inv Group

12Years experience in consulting and advisory services with

Dominion Consulting Services. CFO of CABS.

Brett Ivor Childs 30years experience in change management, capital raising, IPOs,

Non-executive director corporate actions and investment strategy.

App: 14March2017 Director of a number of private and public investment businesses

Largely with a pan African focus including Brainwork’s Ltd

Where he is the CEO of this JSE listed company, the ultimate

Major shareholder of Dawn Properties Ltd.

Peter Saungwene Chartered Accountant. Holder of Bachelor of Accounting

Non-executive director Sciences Honours and degrees from UNISA, CTA and an

App: 3Aug207 Advanced Diploma in Auditing. Finance Director of Dawn

Properties Ltd, Financial Controller of Eco bank Zim Ltd and

CFO at Cell Holdings Pvt Ltd. Audit background worked for

KPMG Zim and KPMG Namibia for a combined 5years.

Patrick Jabulani Matute Holder of Bachelor of Commerce Honours in Finance with

M.D University of Witwatersrand and NUST and a Masters of Business

App: 1Dec2015 Administration from Hult International Business School.Serverd

At Questco a boutique corporate finance company in Johannesburg

And many others

Lloyd Mhishi Founder and current senior Partner of the law firm-Mhishi Nkomo

Non-executive director Legal Practice based in Harare. Practiced Law since 1993. He has

App: 1July2017 been a director and member of several corporations including FBC

Building Society, Council for Legal Education, ZIMSEC, ZECO

Eco bank Zim etc. Lecturer and Department Chairman-Procedural

Law Dept. at UZ for more than 15years.

Graham Paul Johnson Extensive experience of working at board level, setting strategy and

Non-executive director Direction and implementing decisions. He established GPJ Projects in

App: 28Aug 2018 2016 a consultancy business. M.D of Boschendal Wine Estate

Property Development Co. Executive Director of Zim Sun ltd now

African Sun Ltd. Studied Advanced Management Programme with b Oxford University, Property Development with UCT.

Formai Mashame Myambuki Chartered Accountant Zim with 10yrs experience. Holder of

Finance director Bachelor of Accounting Sciences, Post graduate in Accounting

App:1Dec2018 Sciences and Applied Accounting Sciences with UNISA and

CTA. Served at FMCG, Finance Executive and Head of Internal

Audit roles at Cell Holdings, Lobels Holdings and Fidelity Life

Assurance of Zimbabwe.

The board is responsible for the strategic direction of the Group as well as reviewing and approving the investment policy and all significant transactions. The Board has ultimate responsibility for proper management, risk management and the general compliance and ethical behaviour of management. To achieve this, the Board has formed three committees to give special attention to each specific area.

- Audit and Risk

- Finance and Investments

- Human Resources and Nominations.

The audit focuses on providing the board with additional assurance the efficacy and reliability of the financial information used by the directors to assist them in the discharge of their duties. It assures the board that adequate and financial operating controls are in place and that risks are being identified and managed. The audit and risk committee comprises 3non executive directors. The M.D attends the meetings by invitation. The independent auditors have unfettered access to the committee and its chairman. The committee meets at least 4times a year.

The remuneration and nominations committee has the mandate to ensure that the Group adopts market related remuneration, policies and reviews and approves remuneration for senior executives. It also assesses and makes recommendations to the main BOD on all new director appointments.

The finance and investments committee reviews performance of the Groups investment property. It also makes new recommendations to the board concerning new investment proposals as well as all financing arrangements

The board’s primary role is to create value and protect the interests of the company’s shareholders. The board is accountable to shareholders for the company’s performance and its activities. Communication with shareholders is achieved through the AGM and local media where necessary. Company announcements and corporate information are available to investors on the company’s website.

Industry Overview and Competitive Advantage

Dawn Properties has been offering professional real estate services to Government, Parastatals, Corporates, Institutional Bodies as well as the Financial and Private Sector for more than 30 years. The company earns fees from valuation & advisory services and property management commission from 340 000m²of accommodation which consists of 125 buildings and 757 leasesmanaged on behalf of 19 clients.

The company has offices located in Harare and Bulawayo managing the portfolio, with the Harare team managing the northern region of the country whilst Bulawayo manages the southern region. The company has properties in Harare, Gweru, Masvingo, Bulawayo, Mutare and Kwekwe.It operates in the consumer services sector.

Dawn properties offers a comprehensive portfolio of services which include.

- Property sales and leasing,

The firm provides brokerage services for individuals, tenants and property owners in the office, industrial, land and retail sectors as well as residential sectors. Supported by superior market research & analysis, and the industry-specific expertise of their specialty services groups, each transaction is approached strategically, combining local knowledge with global reach. The firm crafts marketing strategies to capture buyers’ focus and leverage market competitiveness. By positioning and targeting properties to the most qualified buyers, the firm attains maximum value for your properties.

- Property management,

The division crafts management solutions for individual properties and large portfolios that offer tangible results across the office, industrial and retail property spectrum.

They develop and implement a value enhancement plan on each unique asset, which focuses on revenue value enhancement, operational efficiency, leasing and servicing excellence, whilst managing effectively the risks associated with the ownership of property. Extensive resources give the firm the ability to offer effective and unmatched management services.

- Research,

Clear and rigorous analysis is the foundation of their property investment advice. Constantly evolving under different sector performances, the firm addresses these needs for continuous market monitoring, delivering incisive and practical research solutions to clients’ specific requirements. The comprehensive services include quarterly reports, information data bank, property index, market research report benchmarks.

- Project and Development Management

The wide-ranging skill base allows the firm to offer strategic consultancy to full development and project management services: a complete series of solutions tailored to the specific challenges of a client’s project. Comprehensive services include quantity surveying, research and development services, architectural services and engineering services

- Valuation advisory services

The valuation advisory services division of Dawn Property Consultancy focuses on providing accurate, timely, supportive conclusions of value for all types of plant, machinery and equipment as well as land buildings and farms.The department comprises of two main divisions: –

– Plant and Machinery

– Land, Buildings and Farms.

Plant and Machinery is the specialist industrial plant, machinery and equipment valuation whilst the Land, Buildings and Farms division aims to provide the most effective and accurate valuation services that are the cornerstone of best property practice and specializes in land and buildings valuations.

Operating Environment

The economy continues to be curtailed by inflationary pressures and acute shortages of foreign currency, that have resulted in shortages of electricity, fuel, essential drugs and an increase in the cost of basic commodities. The net effect of this has been evident with the more pronounced erosion of household incomes, savings and purchasing power. Internationally, our major source markets in the West face uncertainty in the face of a chaotic Brexit and a trade war between the USA and China. In an effort to address the aforementioned challenges, monetary and fiscal authorities introduced a number of interventions. These, among other measures, include the gazetting of legal instruments to enable the exclusive use of the Zimbabwe dollar for domestic transactions, injecting new notes and coins as well as introducing pricing for fuel and electricity which approximates market realities.

The parallel market foreign exchange premiums against the interbank market, continue to hinder national efforts towards formalizing the foreign exchange market in Zimbabwe. In line with the country’s exchange control guidelines, export proceeds beyond the permitted retention thresholds are at the appropriate time acquitted at the prevailing interbank rates. The major factors of production are however being indexed to prevailing parallel market rates resulting in loss of economic value to exporters as a result of distortions between the realized value of export proceeds and the production cost of the exports.

OPERATIONS

Hotel portfolio

Trading conditions were subdued compared to the same period last year. Local demand was on the decline as the economy continues to decline. Salary increases across the board have not caught up with increases in prices forcing most consumers to reduce expenditure on luxuries like travel. Internationally, our major source markets in the West face uncertainty in the face of a chaotic Brexit and a trade war between the USA and China. As a result, overall Occupancy was down 10% compared to the same period last year.

Hotel Improvement Plan

The tenant continues to make significant strides in improving the overall hospitality experience and positioning our properties as “the go-to destination for hospitality”

Holiday Inn Mutare – A new modern restaurant was commissioned in the first half of the year. Work has already commenced to convert one of the storerooms into a gym, in line with the global standards for IHG Branded Hotels.

Carribea Bay Hotel – Mockup rooms have been completed in the first half of the year for the three types of rooms available at the hotel. The tenant intends to roll-out the works on all the rooms by the end of 2019. Further, a new Camp Site has been constructed and will be rolled out in Q3 2019.

Great Zimbabwe Hotel – The board took a decision at the end of 2018 to suspend the use of the Great Zimbabwe Indaba Hall after it developed structural defects. After further assessment, a decision was made to construct a new hall. Work on this has been completed. The tenant will commence soft furnishing of the property with a view to officially open the building by October 2019. While the onus of performance of repairs and insuring of our hotel assets lies with the lessee, i.e. African Sun Limited, we play a key supporting role to ensure that performance is high as this directly impacts our revenue line on rentals.

Valuation

We issue a BUY recommendation on Dawn Properties Limited with a target price of USc 68, representing a 6819% upside from the closing price of USc 1.00 per share of May 22rd, 2020.Our target price calculation is based on a mix of the Discounted Cash Flow (DCF) to Equity model with a target price of USc 90 and P/E/G multiple with a target price of USc 2.79. We respectively attributed weights of 75% and 25% to each methodology. The choice of attributing less weight to multiples methodology is driven by the lack of comparable companies to Dawn Properties Limited. In addition, the intrinsic FCFE method allowed us to include the cyclicality of market environment of Dawn products. We have also used a 3 stage Dividend Discount Model but decided it will be prudent to attribute a zero weight to this methodology. This is because Dawn has does not have a long and stable dividend payout history.

Sales higher than consensus expectations. In the preceding financial year, Dawn has achieved a total revenue growth rate above 120%, outperforming the management target. We believe the outperformance will be sustained in the short term. We expect a total sales growth of 14% in FY20 and the 5 years that follow.In 2020, when a -3.8% growth is expected in the overall industry, Dawn is expected to mitigate this drop by increasing its market share and as a result to achieve a positive, rather negative top line growth.

Estimating the risk-adjusted discount rate. We apply a WACC of 17.27% to discounting the FCFE. The company has a targeted level of Net Debt to EBITDA of ~1.1x giving an optimum debt weight of 6.7% of enterprise value. The computation of cost of equity is based on the Capital Asset Pricing Model using the following inputs: a) risk-free rate equals Government bond rate b) market risk premium of 2.4% c) comparables raw beta re-levered using Dawn’s current capital structure resulting in a Dawn-Beta of 0.11 c.

Optimistic views on growth. To calculate the growth rate, we weighted on historical Growth, Outside estimates and Fundamental growth. Historical was established form a stable trend of revenue by the company to which it ranged the years 2016-18 .Outsides Estimates incooperated growth expectation on the economy in terms of GDP and the company`s growth potential in terms of its balance sheet to which a stable period as applied in historical was used. Finally Fundamental dealt mainly with debt, tax and interest components. This approach results in a positive growth rate of 14.44%. We believe that this rate also reflects the rapid Industrial advances, increasing returns on Development and a maturing market with moderate volume growth and innovations.

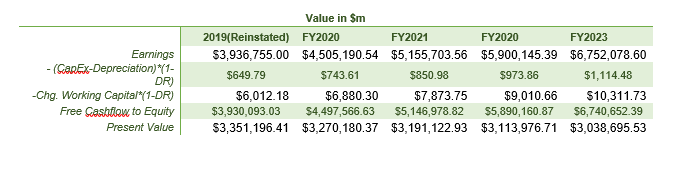

Intrinsic valuation: free cash flow to the firm. The FCFE model was selected because Dawn has a stable Free Cash Flow to Equity, which is expected to increase over time in three phases. The first phase of strong organic growth is based on a specific year-to-year forecast up to 2022 including a market contraction in 2020 when we believe Dawn will be able to process its existing backlog. The second phase of a linear growth decline ranges from 15% to 4% in 2022-2026 and the third phase consists of constant growth of 2.5%. Based on our FCFE analysis, the estimated price is USc 90.

DCF analysis reveals an undervalued valued share price. To assess the robustness of our DCF valuation, we evaluated the sensitivity of our result for the most influential inputs, namely WACC and the terminal growth rate. These results reinforce our positive view of industry growth rates and the belief that VAT’s strategic agenda is not fully reflected in the share price with a considerable premium. Implied DCF sets a required annual cash flow growth at 14.44% for the next 5 years.

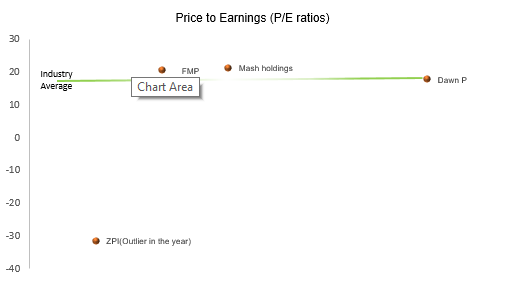

Multiple analysis: an undervalued company in a rapidly-growing industry. Using commonly accepted ratio of P/E, we see Dawn trades at a premium to the market which in our opinion are both justified, taking into account higher earnings growth. To perform a more comparable and sound multiple valuation we chose Price to Earnings to Growth (PEG) as the most appropriate multiple to compare Dawn to its peers. We used the PEG approach mainly because Dawn operates in a high growth industry and one weakness of the P/E ratio is that its calculations do not consider the future expected growth of a company.

Even though earnings and earnings growth may fall victim to different accounting treatments under managerial discretion, we use it to better visualize the premium that investors are ready to pay. For the composition of the peer group, we chose a basket of peers from industrial property sector, in which Dawn and its customers operate

We forecast a 14.44% growth in revenue for the financial year ending 2020 (FY2020). Compared to an industry average PE ratio of 19.90x, the fair value price will be USc2.79, implying a significant undervaluation to the current price of USc1.00.

The following table gives a summary of the outcomes of our different approaches and the outcome;

| Valuation Table Blended | |||

| Method | Weight | Fair Value Usc | Weighted Value |

| FCFE | 75% | 90 | 67.5 |

| P/E Relative Valuation | 25% | 2.79 | 0.7 |

| Blended | 100% | 68.2 |

RESULTS OF THE EXTRA-ORDINARY GENERAL MEETING OF SHAREHOLDERS OF DAWN PROPERTIES LIMITED

Announcement of the results of voting at the Extraordinary General Meeting of shareholders of Dawn Properties Limited held at 10:00 AM on 19 October 2020 regarding the proposed acquisition of the entire issued ordinary shares of Dawn Properties Limited in exchange for an issuance of African Sun Limited ordinary shares listed on the Zimbabwe Stock Exchange through an issuance of 1 African Sun ordinary share for every 3.988075946 Dawn ordinary shares held.