By Gerald Macheka

TODAY’s business world places a premium on the relationship between entrepreneurship and economics. The macroeconomic climate influences key entrepreneurial decisions. Entrepreneurs must always pay attention to crucial economic indicators in order to make sound and relevant business decisions.

Entrepreneurs must carefully evaluate which sorts of economic clutter existing in the media and marketplace they should pay attention to, as well as what factors to consider when formulating strategic growth strategies – both short- and long-term.

As a result, entrepreneurship and economic development are linked in a variety of ways. Because any lack of development for small businesses has the ability to hinder an economy, economic development is somewhat dependent on entrepreneurs. Meanwhile, to create jobs and generate sales, new business owners rely on a growing and stable economy.

This article will look at four critical economic indicators that all Zimbabwean entrepreneurs should be aware of: Economic growth, inflation, interest rate, and unemployment.

Economic Growth

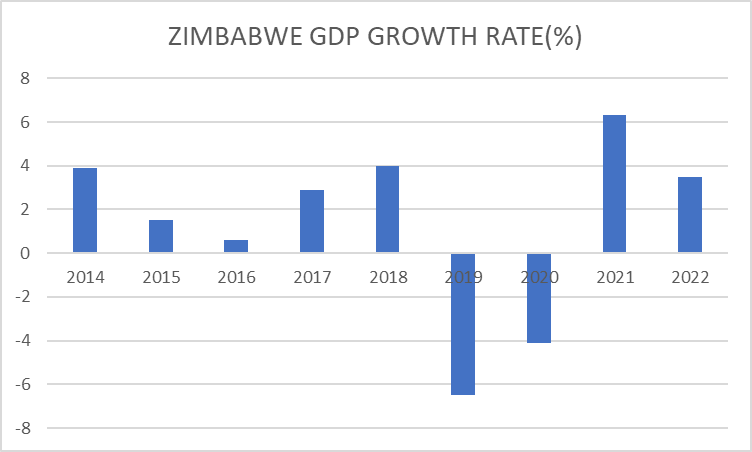

Economic growth is most likely the most crucial factor influencing corporate success. As a business, meeting the expectations of a powerful economic environment go without saying. The quantity of money invested in long-term improvement channels, as well as the finances of people living in the society at large in a given country, is determined by the country’s economic growth. On the strength of a large maize crop in the 2020/21 farming season, as well as a robust pick-up in mining and buoyant construction, real gross domestic product is expected to decelerate to 3.5 percent this year, down from 6.3 percent in 2021. Entrepreneurs can use such estimates to predict business growth strategies.

This information can be used by a successful entrepreneur to forecast whether a particular industry will expand or decline. Businesses prefer to store more as a backup when the GDP is expected to fall, which entails layoffs and cost-cutting measures.

The entrepreneur can use this indicator to determine which decision is better for the company. A trend analysis is also necessary. A strong economic outlook tends to stimulate the growth of a business. As a result, this is a crucial metric to examine.

Inflation

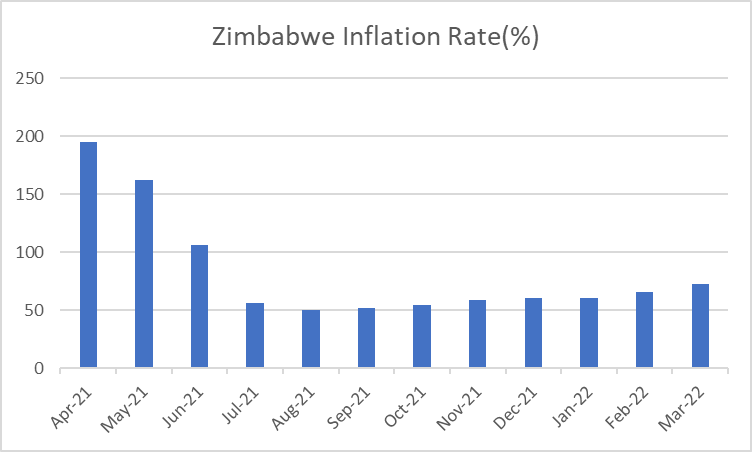

Inflation usually happens when the quantity of money exceeds the supply of goods and services. The cost of raw materials, production, and utilities all rise as a result. Goods prices must rise in order to keep the business afloat. As a result, unless employers boost salaries in line with inflation, inflation can lower consumers’ purchasing power. Inflation tends to inhibit investment and long-term economic growth for entrepreneurs. This is due to the increased likelihood of uncertainty and misunderstanding during periods of high inflation. Low inflation is said to promote better stability and encourage businesses to invest and take risks. Inflation can make a business unprofitable. As inflation becomes unmanageable, entrepreneurs’ investment prospects become less favorable.

Looking at this graph, it is clear that Zimbabwe’s inflation rate is uncontrollable and always on the rise. Entrepreneurs require this information in order to budget for the costs associated with changing nominal prices in general. In this sense, menu costs could include things like updating computer systems and re-tagging items. In Zimbabwe, this is a nightmare for entrepreneurs.

Interest rates

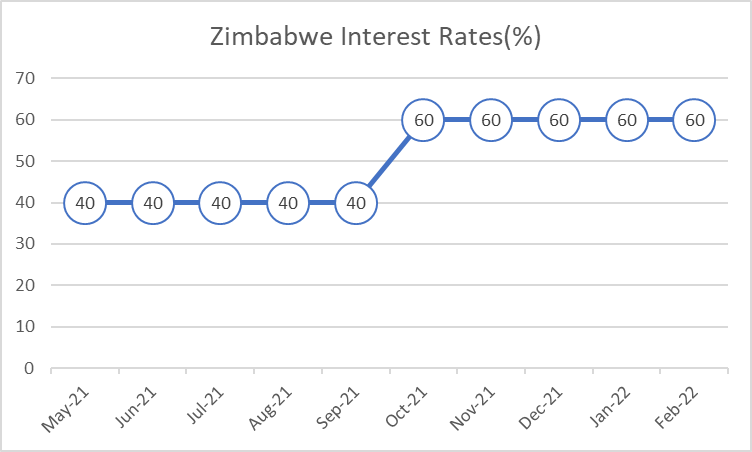

Interest rates are the last but not least crucial aspect. They are the fees charged by a lender to an individual or corporation who wishes to borrow money. Many small and medium-sized firms rely on bank and other financial institution loans for capital. Increased total corporate expenses are caused by high interest rates.

The state of the economy has an impact on interest rates, which can either support or hinder corporate expansion. When the economy is strong, interest rates tend to climb, and when the economy is weak, interest rates tend to fall. When interest rates are low, consumer and company spending can drive up asset prices. For entrepreneurs, interest rates are critical in determining price decisions based on economic spending levels. Borrowing money for consumption now is more expensive due to higher real interest rates. Similarly, deferring consumption to the future will be more advantageous.

Unemployment

The employment situation is another important facet of the economy that has an impact on business operations. Individuals’ purchasing power is directly affected once again. Because most people have money to spend while unemployment is low, consumer spending tends to be higher. This is beneficial to businesses and promotes expansion. 46.4 percent of persons are employed in the informal sector, according to the 4th Quarter labor force survey. This essentially indicates that employees play a big role in the informal economy. Entrepreneurs can utilise this information to develop strategies to break into the informal sector rather than relying solely on formal channels for finding skilled labor.

Conclusion

Macheka is an economist and Financial analyst at EquityAxis,a leading financial research firm-geraldm@equityaxis.net